- August 4, 2023

2024 will be an Election Year in Which We Will Elect... A President, Vice President, All 435 House Seats and 34 of the 100 Senate Seats

- 04 August 2023 | Gregory J. Cook, EA, CPA

In my lifetime, I have never witnessed divisiveness in politics such as we've seen since 2016. It seems as though each day, we are inching closer and closer to an all-out war between members of the two major parties. Objectively, I have seen the good and bad that has come from both of our major political parties. Before I digress too much, I will get back on track and ask that you put on blinders to Party Politics for the next 5 minutes.

How Might the Coming Election Year Affect Your Taxes?

We could possibly see a turnover in the office of the President and Vice President. Why do I say that? Remember My Blinder Request Please: Since our current President took office; inflation has reached a 40-year high, interest rates have reached a 22-year high and consumer debt just reached an all-time high this year (more than $17 Trillion).

$676 Billion in Tax Increases were included in the 2022 Inflation Reduction Act (which is a 10-year plan where changes did not happen immediately). Part of that plan included providing the IRS with $80 Billion for enforcement, to hire 86,852 new full-time employees. Supporters of the new IRS budget and hiring plans argue that 50,000 IRS employees will be retiring in the coming years. However, if 50,000 salaries go away, the IRS should not need more money to replace them. The new hires' starting pay will be far less than senior-level retirees. These are all factors that weigh heavy with voters.

Tesla may be using that banner to sell more cars, or they might be issuing the warning for internal reasons. For example, in 2024 the cars may have batteries that are made in China, which would lower the tax credit from $7,500 to $3,250. Another possibility is that Tesla expects the 2024 MSRP of their currently qualifying cars to exceed the $55,000 cap set in the tax code.

All 435 voting seats in the United States House of Representatives will be up for election. Additionally, elections will be held to select the delegate for the District of Columbia as well as the delegates from all five U.S. territories, including the Resident Commissioner of Puerto Rico. Republicans hold a narrow majority in the House of Representatives following the 2022 U.S. House elections. Will the majority change? Anyone's guess is as good as mine.

It was the Inflation Reduction Act of 2022 that gave us all of these energy savings tax credits. All Democrats in the Senate and House voted for the bill while all Republicans voted against it. I've often said that almost everything in life has a good side and a bad side. That is certainly the case when it comes to this law and your taxes.

Of the 34 Senate Seats up for grabs, 23 are currently held by Democrats. Three Democratic-held seats up for election are in the heavily Republican-leaning states of Montana, Ohio, and West Virginia, all of which were won comfortably by Trump in both 2016 and 2020. So it would appear that the Democrats are more at risk of losing seats, but only because they have more up for election in this cycle. The odds greatly favor a turnover in control of the Senate.

What do the Las Vegas Oddsmakers Say?

Las Vegas odds currently favor the Republicans retaining the House and because the Vice President is the tie-breaker vote in a 50/50 split Senate, the Republicans have a slight edge to regain control of the Senate.

Abraham Lincoln said "the best way to predict the future is to create it."

Rarely do I have blanket tax advice, however, just now I am strongly favoring any 2023 energy saving expenditures that will qualify for tax credits. Call and discuss with us before taking action. These tax savings should be locked-in this year before it is too late.

2023... The Time is Now

~ Greg Cook

If you make energy improvements to your home, tax credits are available for a portion of qualifying expenses. The credit amounts and types of qualifying expenses were expanded by the Inflation Reduction Act of 2022. We'll help you compare the credits and decide whether they apply to expenses you've already paid or will apply to improvements you're planning for the future.

Homebuilders can Qualify for a $5,000 Tax Credit

Example: George needed to replace an electric water heater in his home. He purchased a natural gas, instant water heater and will receive a tax credit for 30% of the cost when he files his taxes. In addition, the gas company offered a $600 rebate for switching from the existing electric storage water heater to a natural gas tankless water heater that is high efficiency.

As a result of this upgrade, George saw a decrease in his monthly electric bill of approximately $43 and an increase in his gas bill of about $10 per month.

Had George purchased a new 40 gallon electric water heater for approximately $500, his real cost would have been about $650. This is because George would have to work and earn $650 in order to have $500 leftover after-taxes to shell out for the water heater.

The high effiency tankless water heater cost $520 ($1,600 less $480 tax credit less $600 utility rebate). The reduced utility bills over the life of the water heater will essentially mean that the change made money for George. Money that he could spend on his wife, Lisa.

Energy Efficient Commercial Building Deduction

Building owners who construct energy efficient buildings or increase the energy efficiency of existing buildings by at least 25% may be able to claim a tax deduction. An increased deduction may be available for making higher efficiency improvements and meeting prevailing wage and apprenticeship requirements. The deduction is allowed under Internal Revenue Code (IRC) Section 179D. It was expanded under the Inflation Reduction Act of 2022.

Details from irs.gov about who is eligible, buildings that qualify and more here.

Businesses accommodating people with disabilities may qualify for some of the following tax credits and deductions:

- 1) Disabled Access Credit

- 2) Barrier Removal Tax Deduction

- 3) Work Opportunity Tax Credit

Small Businesses

~ Greg Cook

Hedging Your Bets: Sole Proprietors & LLCs

There was a time that I may not have recommended creating an LLC (Limited Liability Company) unless the client business had some potential inherant liability. Beginning in tax year 2023, Alabama has a new law that cuts the annual $100 minimum business privilege tax in half to $50 for small businesses, and it completely exempts small businesses from the minimum tax beginning in 2024. Nowadays, with the filings and fees being decreased, it is a lot less expensive and bothersome to have an LLC.

LLCs are subject to fewer regulations than traditional corporations, and thus may allow members to create a more flexible management structure than is possible with other corporate forms. As long as the LLC remains within the confines of state law, the operating agreement is responsible for the flexibility the members of the LLC have in deciding how their LLC will be governed. State statutes typically provide automatic or "default" rules for how an LLC will be governed unless the operating agreement provides otherwise, as permitted by statute in the state where the LLC was organized.

Tip: If you plan to start a business in 2023, talk to us. There are many planning opportunities offered by the LLC, like for example, the ability to later make an election to be treated as an S-Corp.

Can An S Corporation Make Disproportionate Distributions?

This question was posed to me this week. The tax code pertaining to the Sub-Chapter S Election is one of the most commonly misinterpreted or misunderstood areas of tax law. For that reason, many taxpayers avoid the S-Corp status because they have been misinformed about this entity election. The assertion that all distributions must be equally proportionate to stock ownership, all the time, is not exactly true at all.

IRC Section 1361(b)(1)(D) says that in order to make an S Election, a corporation must have only one class of stock outstanding. All members must have identical rights to distribution and liquidation proceeds.

A disproportionate distribution does not in and of itself automatically create a second class of stock or membership in the LLC.

Under an IRS Audit, the service is going to look to see that each member reported their proportionate amount of income (the amount of distribution a member received in a particular year does not have to match the K-1 amount. The auditor will likely look to the Operating Agreement or Articles of Organization to ensure that the members have equal rights and entitlements.

Yes, you will need to eventually reconcile the distributions. Using the S-Corp status for a Sole Proprietor business can be very beneficial in transitioning to retirement.

2023 Tax Planning

~ Cook & Co. Tax Advisors

Final Word

With five months left in the 2023 tax year, I simply wanted to encourage two things; energy savings tax credits and limited liability companies for sole proprietors. These recomendations should be discussed with your advisor before taking action.

Thats it! Now is an exciting time to make some very beneficial changes that can have a positive impact for many years into the future and get tax credits for doing it!

Disclaimer: Nothing in this article is meant to disparage either political party or our President. I strived to be politically unbiased (present facts) rather than politically correct (attempting to not offend anyone).

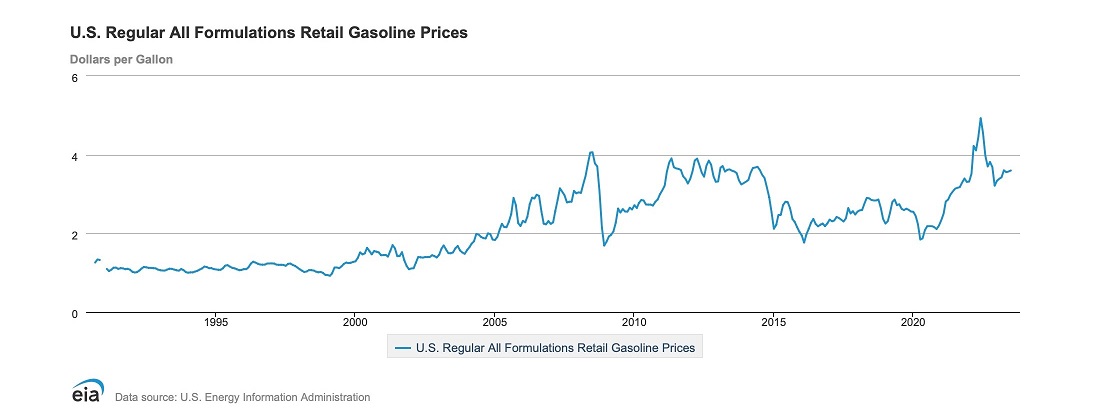

Gasoline Prices Likely Influenced the 2022 Mid-Term Elections and May be a Factor in 2024

Research has shown that there is a direct correlation between Gas Prices and Presidential Approval Ratings. President Biden released more barrels of oil from the U.S. Reserves than every past president combined. Our oil reserves are at the lowest level since 1984. Our reserve contained 372 million barrels as of March 2023, almost half as much as the all-time high of 727 million barrels in 2010. Today is August 4, 2023 and gas prices are 47% higher than they were in February 2020 when Biden took office.

NOTE: Flooding the market with government-owned oil will likely not be an option in the coming year. Building back those reserves may cause prices to go higher in the future.

Tax Credits for New Clean Vehicles