-

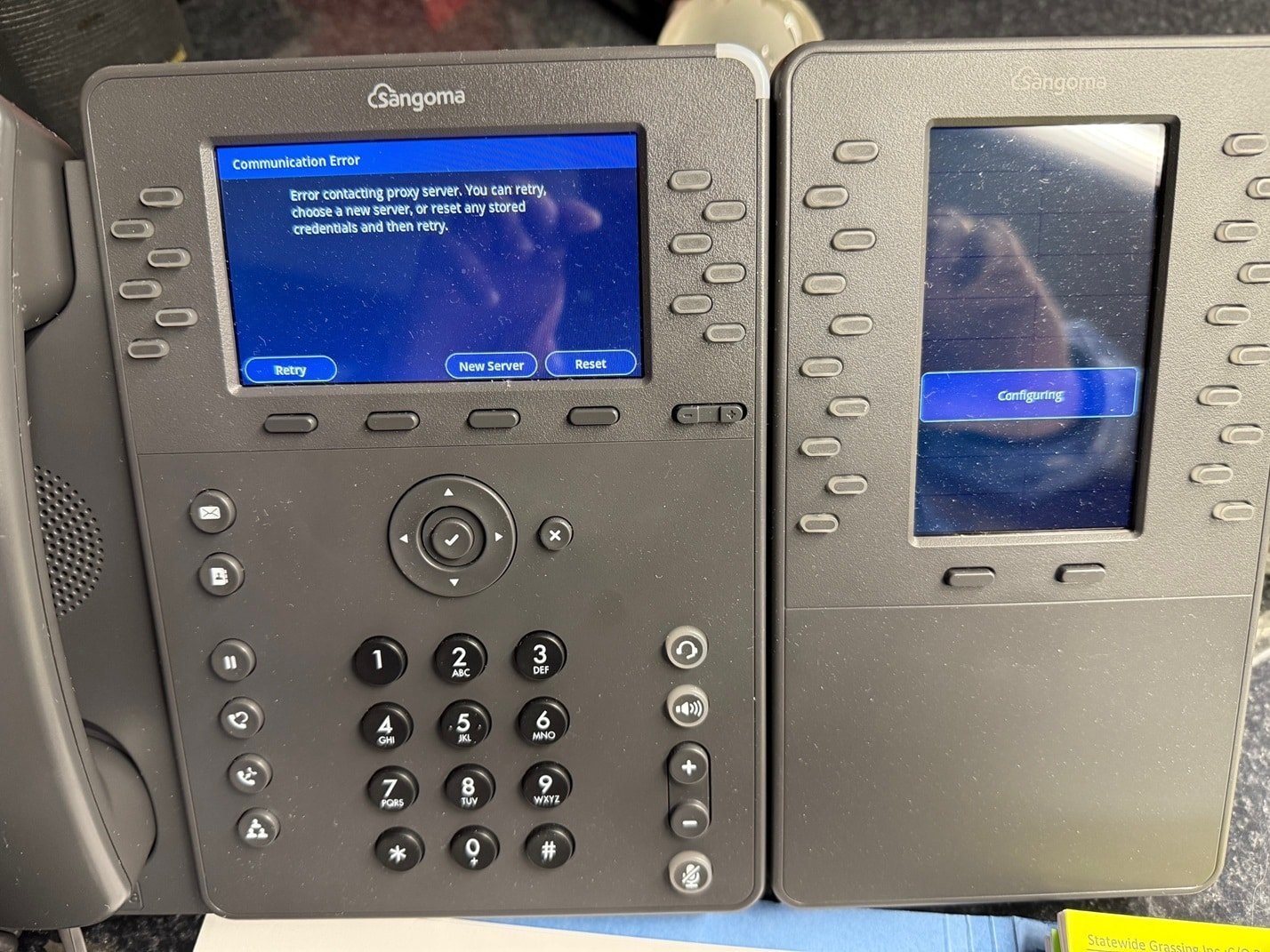

Phones Down Monday 10-21-2024

Our phones are down this morning. If you need to reach us please email or call our Birmingham number 205-322-7452.

-

Closed for Columbus Day

We will be Closed Monday October 14, 2024 for the federal holiday.

-

Employer Educational Assistance Programs

Employer educational assistance programs can still be used to help pay off workers’ student loans through Dec. 31, 2025 Though educational assistance programs have been available for many years, the option to use them to pay for workers’ student loans has only been available for payments made after March 27, 2020. Under current law, this…

-

Beware of Promoters – Settle Your Taxes for Pennies on the Dollar

IRS warns of ‘mills’ taking advantage of taxpayers with Offer in Compromise program The Internal Revenue Service reminds taxpayers to beware of promoters claiming their services are necessary to resolve unpaid taxes owed to the IRS while charging excessive fees, often with no results. These unscrupulous “mills” use aggressive marketing to make false claims of…

-

IRS Provides Relief to Francine Victims

The Internal Revenue Service announced today tax relief for individuals and businesses in the entire state of Louisiana, affected by Tropical Storm Francine that began on Sept. 10, 2024. These taxpayers now have until Feb. 3, 2025, to file various federal individual and business tax returns and make tax payments. The IRS is offering relief…

-

Taxpayer Advocate Service

A taxpayer’s voice at the IRS The Taxpayer Advocate Service is an independent organization within the IRS. TAS protects taxpayers’ rights by striving to ensure that all taxpayers are treated fairly and know and understand their rights under the Taxpayer Bill of Rights. Here’s what all taxpayers should know about their rights and the role of the…

-

Taxpayer Bill of Rights

By law, all taxpayers have the right to finality of federal tax matters Taxpayers have the right to finality when working with the IRS. For example, taxpayers have the right to know when the IRS has finished an audit. This is one of 10 basic rights, known collectively as the Taxpayer Bill of Rights. Here’s what…

-

Office Closed for Labor Day

-

Expanded Customer Parking Project Underway

The Post-Pandemic Era has Come with Many Challenges, many Benefits as Well. Almost everything in life has a good side and a bad side. That has certainly been the case for many business activities in this post-pandemic environment. It was three years ago that I acquired property on the south side of my business in…