-

Google Rocks! Well, sometimes.

According to Google, 1,520 people found us on their search engine last month. 94 people called us, 62 people visited our website and 14 people asked for directions to our office, all from Google searches. In addition, Google reports that we have a 5 Star Rating and that this photo of Dustin Toney is very…

-

Where Do You Stand Under the New Trump Tax Plan?

This time of year I don’t get to see the news on TV because of the long hours at the office. But my wife tells me I should address this. According to the news, many people are seeing smaller tax refunds than last year due to the changes to the withholding tables. Even though their…

-

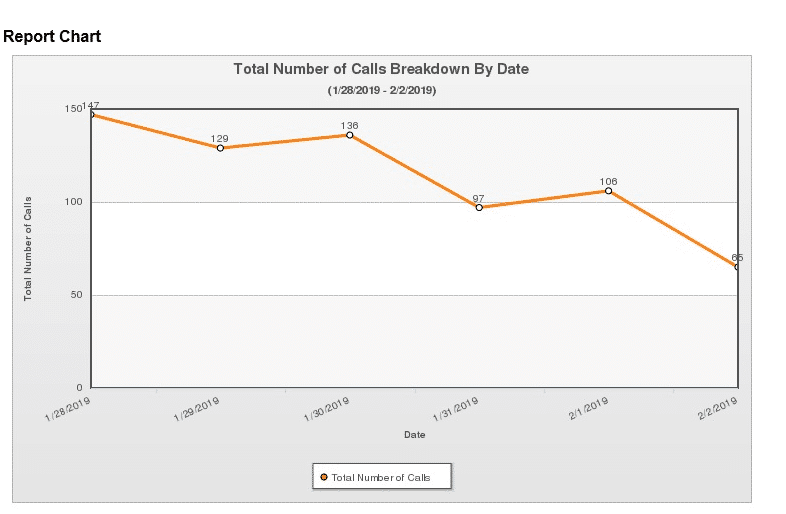

We Averaged 113 Telephone Calls Per Day at the Office Last Week

Most of the inquiries we receive are regarding our fees, which are routinely $300 to $500 ($385 average) for individuals. The best days to call appear to be Wednesday, Friday or Saturday.

-

A Tip from the Internal Revenue Service

IRS: Don’t be victim to a ‘ghost’ tax return preparer Today, towards the end of the second full week of the 2019 tax filing season, the Internal Revenue Service warned taxpayers to avoid unethical tax return preparers, known as ghost preparers. By law, anyone who is paid to prepare or assist in preparing federal tax…

-

Tax Season is Getting Off to a Busy Start!

If you have not yet scheduled your appointment, I encourage you to book the time slot that works best for you early. Tax Season office hours are 8am to 8pm Monday through Friday and 8am to 5pm on Saturdays. Appointment times are available on the hour at 9, 10 and 11 in the mornings. Afternoon…

-

Licensed Real Estate Agents

Most real estate professionals operate their business as a sole proprietorship. This means that you are not someone’s employee, you haven’t formed a partnership with anyone, and you have not incorporated your business. Statutory Nonemployees Licensed real estate agents are statutory nonemployees and are treated as self-employed for all Federal tax purposes, including income and…

-

Advances in Technology

2019 is getting off to a great start with improvements and upgrades in our Data Center! The back-end technology we utilize to accomplish our mission is out of sight (downstairs) and out of mind, but it really is the backbone and driving force behind our day-to-day operations. Without it we could not process the volume…

-

Treasury, IRS issue Final Regulations, other guidance on new Qualified Business Income Deduction

Safe harbor enables many rental real estate owners to claim deduction. The Treasury Department and the Internal Revenue Service issued final regulations and three related pieces of guidance, implementing the new qualified business income (QBI) deduction (section 199A deduction). The new QBI deduction, created by the 2017 Tax Cuts and Jobs Act (TCJA) allows many…

-

Holiday Closing

As we have every year since 1995, our office will be closed for two weeks in order to upgrade equipment and prepare for Tax Season. We will return on Monday January 7th. HAPPY HOLIDAYS EVERYONE! If you have an urgent need during this two week period, you can email greg@bara.net. Greg Cook is an Enrolled…