-

After Closing at 5, Our Office will be Closed the Balance of This Week

We will reopen Monday April 25th at 9:00 am. Today we will be filing extensions and getting vouchers and other documents to clients. We do not file tax returns today, as we will not be back in the office until Monday April 25th. It generally takes 24 to 48 hours to receive the Acknowledgement of…

-

OTELCO, Our Local Telephone Company Has Problems Again

All of our incoming and outgoing telephone service is temporarily down this Monday morning 04/11/2022. It has been down since noon on Saturday 04/09/2022. The telephone technicians are supposed to address the problem this morning. It was 30 days ago when one of their Adtran Network Cards died. Whatever the issue is, the telephone company…

-

Why We Avoid Sending Paper to the IRS

As of March 18, the IRS has a backlog of 15 million paper tax returns for the 2022 tax season. All of which, must be processed by workers typing out each digit and each letter! Of course there are times when we have to correspond with them, but we are encouraging taxpayers to file and…

-

The April 18th Tax Filing Deadline

With less than 2 weeks to go, we are quickly running out of appointment time slots if you want to come into the office. Schedule now, while we have time slots available. Alternatively, we can file an extension and get you in the office the week of the 25th or later.

-

Just An April Fools Day Reminder…

No pranks are allowed in the office on this “Day of Fools” as we approach the tax filing deadline that falls on April 18th this year. “And No, that is not a Joke about the deadline being moved to the 18th this year. The deadline for filing your Federal Taxes this year is Monday, April…

-

For Our Georgia Resident Clients

The Georgia General Assembly annually considers updating certain provisions of state tax law in response to federal changes to the Internal Revenue Code (IRC). There were two IRC update bills this year, House Bill 7EX and House Bill 265. source: Income Tax Federal Tax Changes | Georgia Department of Revenue House Bill 7EX was signed…

-

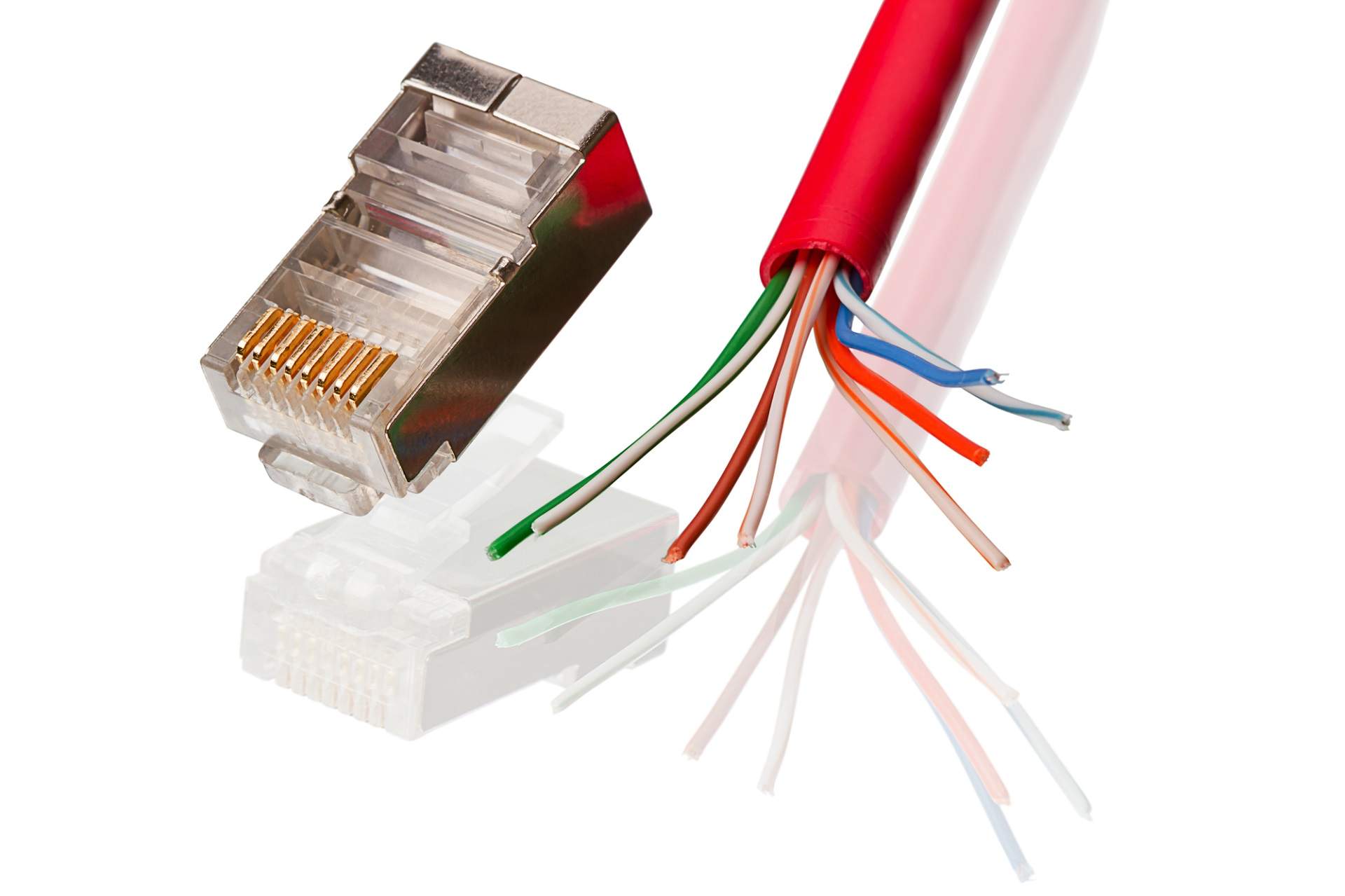

Thank You CWS Security!

Right in our busiest time of the year, we had to replace some of the old Cat 5 cabling in the office. The newest Dell workstations were dropping network connectivity and it turned out to be the firmware in the latest Intel network cards being incompatible with the older Category 5 cabling.

-

The Roads are Clear in Arab

We got a little snow in the early morning hours, but the roads are clear. We have clients scheduled to come in from Oneonta, Gadsden, Huntsville, Memphis, Boaz, Albertville, Madison and Decatur. So far, no cancellations or reschedules.

-

Local Telephone Company, OTELCO, Has Problems

Our local telephone company, OTELCO, has a problem again. Our phones were down all day yesterday. Still down this morning. Trying to get them to address it this morning.