-

After Tax-Season Hours

Our office will close at 5:00 pm Central time today. We will reopen Monday April 23rd at 9:00 am. After Tax-Season Hours: 9-5 Mon-Thu We will be closed on Fridays and Saturdays for the balance of the year.

-

The Week Ahead

On this day of rest, I reflect on last week, our tenth and final full week of the 2017-18 tax filing season. And I look ahead to the coming week and the Tuesday deadline. We will close the office at 5:00 pm on Tuesday and reopen Monday April 23rd, when we will be on after…

-

Tax Filing Deadline Extended to April 17th

This year, Tax Day falls on Tuesday, April 17, a full two days later than normal. April 15 falls on a Sunday in 2018, which would normally push Tax Day to Monday, April 16. That date, though, happens to be when Washington, D.C., is observing Emancipation Day. That holiday honors the 1862 passage of the…

-

Want to File an Extension?

Call us at (256) 586-4111 and we will file an extension for you. If you want to come in the week of the 23rd, we can work up the taxes and file them right away if you want, or delay up to October 15th.

-

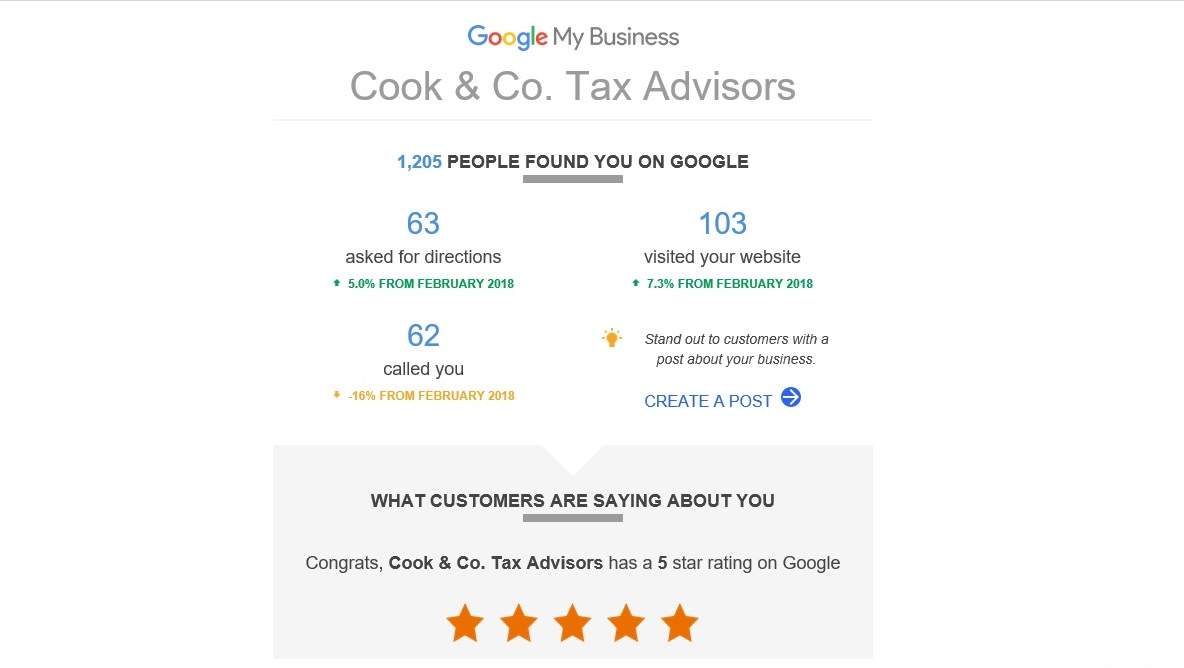

Week 9 of Tax Season

As our ten week season approaches the filing deadline, I want to remind everyone that the deadline was extended to Tuesday the 17th. Month of March Google says that 1,205 people found us using their search, 63 people asked for directions, 103 visited our website and 62 called the office. March was a busy month…

-

Refund: Claim It or Lose It

If you didn’t file a 2014 tax return, you still may be due a refund. Find out how to claim your money before time runs out.

-

IRS issues guidance on Business Interest Expense Limitations

The Treasury Department and the Internal Revenue Service (IRS) today issued Notice 2018-28, which provides guidance for computing the business interest expense limitation under recent tax legislation enacted on Dec. 22, 2017. In general, newly amended section 163(j) of the Internal Revenue Code imposes a limitation on deductions for business interest incurred by certain large…

-

Happy Easter April 1, 2018!

As we welcome Spring and the calendar rolls over to April, we just completed our second busiest week of Tax Season. Historically, the first week of April has always been the most hectic of our ten week filing season. We will be extremely busy getting last minute information from clients that have already been in…

-

Trump Tax Cuts Seem Real

If your income is $250,000 to $500,000, you will see significant tax savings this coming year. If your income falls within the range mentioned above, we are seeing $5,000 to $16,000 tax savings in 2018 under the Trump Plan over the taxes the government kept in 2017. For incomes below $250,000, we see a decrease…