Although we are out of appointment slots, we can still file your taxes. Call the office and ask for us to file an extension. We will review your file and call you to discuss if we think you should pay an estimate electronically by direct debit with the extension.

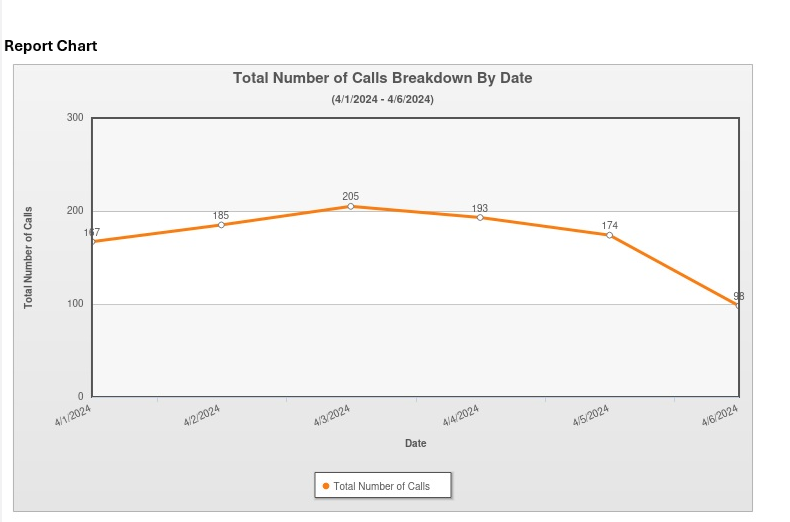

We had more than 1,000 calls last week, 368 incoming and 658 outgoing calls.

Filing an automatic extension of time to file your U.S. federal income tax return is a vital process that allows taxpayers additional time to prepare and submit their returns without facing penalties for late filing. Understanding how to navigate this procedure is crucial for individuals who find themselves unable to meet the original filing deadline, which is typically April 15th each year. This article aims to demystify the process, highlighting the steps involved, key considerations, and the implications of filing an extension.

What is an Automatic Extension?

An automatic extension grants taxpayers an additional six months to file their federal income tax returns. It’s important to note that this extension applies only to the filing of the tax return, not the payment of any taxes owed. If you anticipate owing taxes, it’s essential to estimate and pay the amount due by the original filing deadline to avoid interest and penalties.

How to File for an Automatic Extension

Filing for an automatic extension is straightforward. The most common way to request an extension is by filing Form 4868, either electronically through a tax software program or by mailing a paper form to the IRS. Taxpayers can also obtain an extension by paying all or part of their estimated income tax due using a credit or debit card or the IRS Direct Pay system, indicating that the payment is for an extension.

Key Considerations

- Payment of Taxes: An extension to file is not an extension to pay. Taxpayers must estimate and pay any taxes owed by the original filing deadline to avoid potential penalties and interest on the unpaid balance.

- State Tax Returns: While this article focuses on federal tax returns, many states also require taxpayers to file for an extension separately for their state income tax returns. It’s essential to check the requirements in your state to ensure compliance.

- Benefits of Filing an Extension: Filing an extension can provide additional time to gather necessary documentation, reduce the rush and potential for errors on your tax return, and ensure that you can take full advantage of tax savings and deductions.

- Implications of Not Filing an Extension: Failing to file a tax return or an extension by the deadline can result in late filing penalties, which are typically 5% of the unpaid taxes for each month or part of a month that a tax return is late, up to a maximum of 25%.

Conclusion

Filing an automatic extension for your U.S. federal income tax return can be a strategic decision for many taxpayers. It allows for additional time to accurately prepare and file your return, potentially reducing stress and minimizing errors. However, it’s critical to remember that an extension to file is not an extension to pay any taxes owed. Estimating and paying any owed taxes by the original deadline can help avoid unnecessary penalties and interest. Always consult with a tax professional if you have questions about your specific situation or need assistance with filing for an extension.

Facebook Comments