This is always our busiest time at the office …

Tax season can be stressful, especially if you’re not quite ready by the filing deadline. Fortunately, the IRS offers taxpayers an option to file an extension, granting extra time to complete their tax returns. Here’s what you need to know:

What is a Tax Extension?

A tax extension provides an additional six months to file your federal income tax return. This moves the usual April deadline to mid-October. However, it’s crucial to understand that an extension only gives you more time to file your return, not to pay any taxes owed.

How to File an Extension (Call Us, We’ll Do It for You)

To file an extension, submit IRS Form 4868 either electronically or via mail. Filing electronically through the IRS Free File system or tax software is recommended for speed and convenience. This form must be submitted by the original tax deadline (usually April 15).

Payment is Still Due by the Original Deadline

If you anticipate owing taxes, you must estimate your liability and pay this amount by the original deadline. Failure to do so can result in penalties and interest on any unpaid taxes.

Benefits of Filing an Extension

- Reduces stress by providing additional time to organize your documents.

- Helps prevent mistakes from rushing through the filing process.

- Avoids late filing penalties if you can’t complete your return by the deadline.

Potential Drawbacks

- Interest and penalties on unpaid taxes can accumulate if you underestimate your tax liability.

- Extends the time required to finalize your tax matters (Statute of Limitations).

Final Thoughts

A tax extension is a helpful tool for taxpayers who need extra time. Just remember: always estimate and pay any tax owed to avoid additional costs. Planning ahead ensures that the extension benefits you rather than adding to your financial burden.

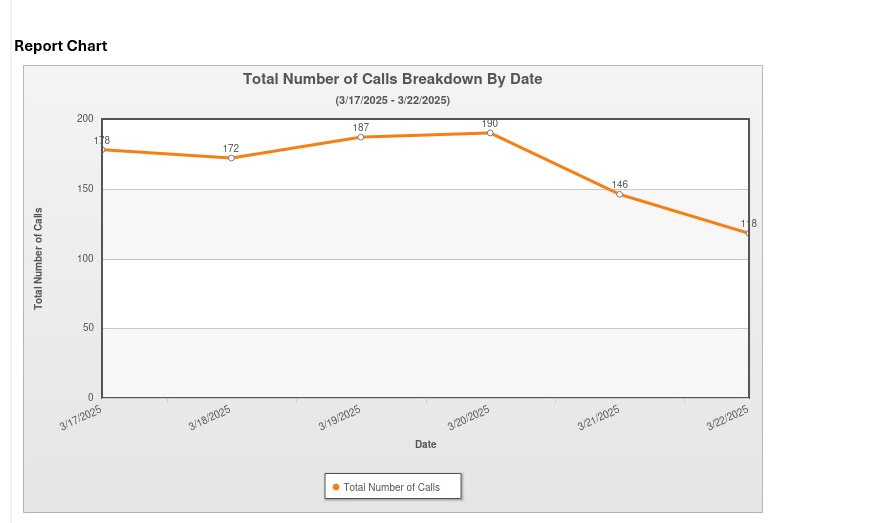

Our Telephone Traffic this week … 992 Calls

A very nice client sent a very nice gift to Amanda to show her appreciation.

Facebook Comments