Summer will be here before we know it! And with June comes the Second Quarter Estimated Tax Filing for individuals with self-employment income.

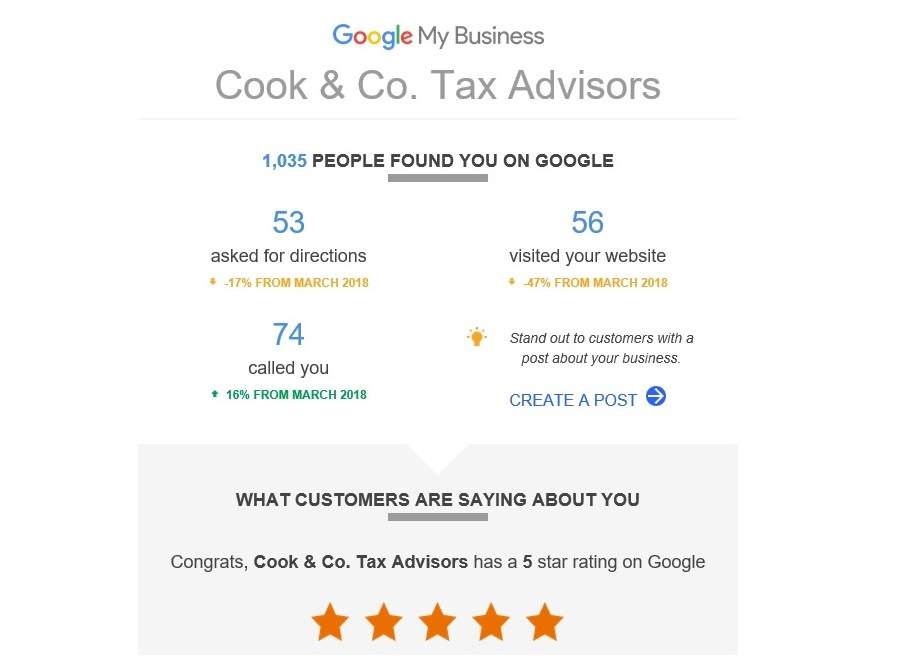

Updates from Cook and Company

Nonprofit tax-exempt organizations using the calendar year as their tax year must file information returns by May 15.

The IRS is warning small businesses to be on guard against a growing wave of identity theft attempts against employers. Identity thieves have long made use of stolen Employer Identification Numbers (EINs) to create fake Forms W-2 to file with bogus tax returns. Now they are using company names and EINs to file fraudulent returns.

See the May 3, 2018, IRS news release, “IRS Urges small businesses: Protect IT systems from identity theft” for more information.

Half of our Tax Department will be attending a tax seminar in Birmingham May 20-22.

Our 2017-18 Filing Season was a Success

Tax Seasons, the ten weeks from February 1 to April 15 are often rattled by a flu outbreak, snow (which can cripple north Alabama) and even tornados. We were pretty fortunate in 2018. Very little sickness, only one snow day and it was January 16th before we actually got geared up. We had tornado and hail warnings on March 19th that caused us to close at noon. The hail that evening was severe in Arab.

Facebook Comments