Today is the 2nd Sunday in March

Daylight Saving Time (DST) is the practice of setting clocks forward by one hour in the spring and back by one hour in the fall to make better use of natural daylight. Originally proposed by Benjamin Franklin and later adopted by several countries during World War I to conserve energy, DST remains a topic of debate. Proponents argue that it reduces electricity consumption and encourages outdoor activities, while critics contend that it disrupts sleep patterns and offers minimal energy savings.

Although many countries observe DST, others have abandoned it due to its questionable benefits and inconvenience. The start and end dates of DST vary by region, with the United States, for example, beginning DST on the second Sunday in March and ending it on the first Sunday in November.

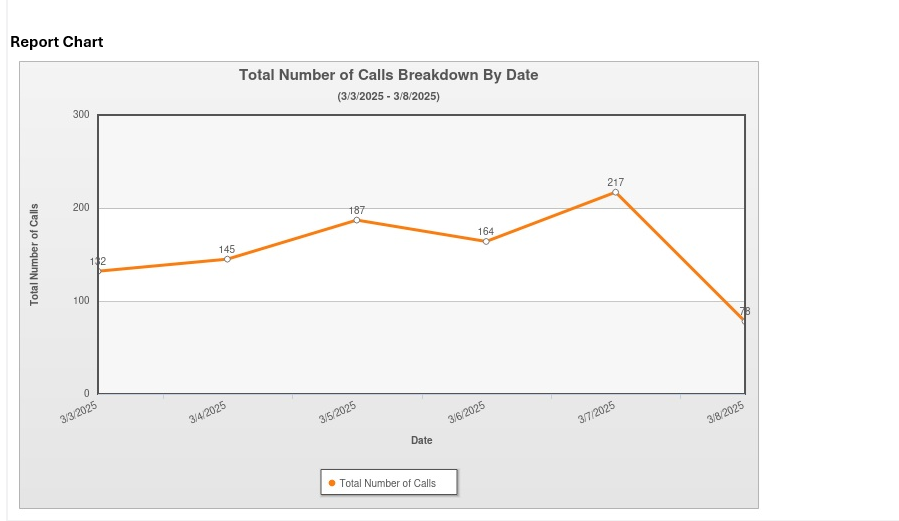

Telephone Traffic – 923 Calls

This past week, we had 430 Incoming and 493 Outgoing Calls. Typical for the first week of March, our telephones are busy with activity as we approach the March 15th filing deadline for S-Corps and Partnerships.

Flu Season is Almost Over

As of the first week of March 2025, respiratory illness activity in North Alabama reflects national trends, with notable observations for influenza, COVID-19, and respiratory syncytial virus (RSV). We have three staff members out sick at the moment. Spring is on the way though!

The Parking Lot is Almost Complete

Please forgive me, I know that to many of you I sound like a broken record or someone with a one-track mind. Parking lot. Parking lot. Parking lot. Yes, my new parking lot has consumed far too much of my attention, thankfully all we have left to complete the project is the wrought iron.

Favorite Question This Week:

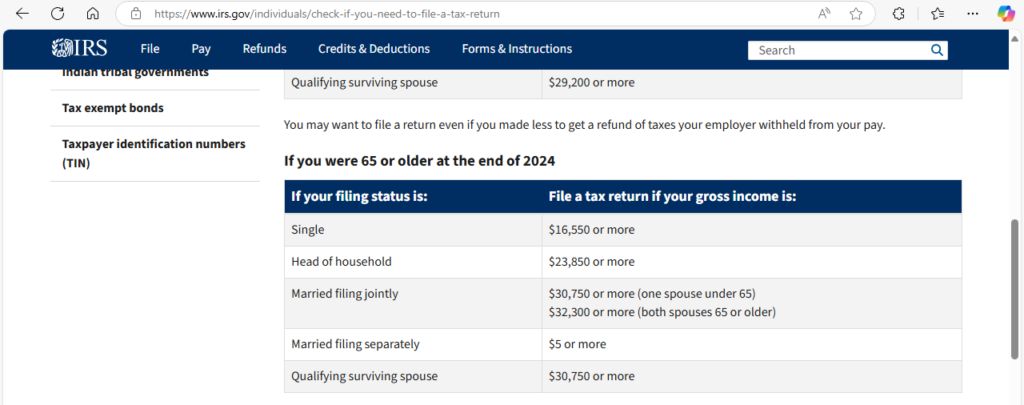

“Is there an age at which one may stop filing income tax?“

There is no specific age at which someone is automatically exempt from filing income taxes. However, older individuals may no longer need to file if their income falls below the IRS filing thresholds. The key factors determining whether a senior must file include:

- Income Level – The IRS sets annual income thresholds that vary by filing status (single, married, etc.). If total income falls below these limits, filing is not required.

- Social Security Benefits – If Social Security is a person’s only source of income, they typically do not need to file. However, if they have additional taxable income (such as pensions, IRA withdrawals, or investment earnings), a portion of Social Security may become taxable.

- Filing Status – For 2024, the filing requirement for single filers 65 and older starts at $15,700 (if only earned income) or $32,000 (if receiving Social Security and other income).

- Special Circumstances – Even if below the income threshold, filing may still be necessary if someone owes taxes on self-employment earnings, early retirement withdrawals, or investment gains.

While many seniors on fixed incomes may not need to file, it’s always a good idea to check annually based on IRS guidelines. Some seniors still file voluntarily to claim tax credits or refunds (such as excess withholding or the Earned Income Tax Credit).

Tomorrow, Monday March 10th, will mark the Half-Way Point of Tax Season after which, we will be half the way to the Tax Filing Deadline of April 15th. As of yesterday, Saturday March 8th, we had issued 1,045 Control Cards or work orders this filing season.

There are many reasons that so many people want this firm representing them with the IRS and State Departments of Revenue, however, the number one reason is the people.

Until Next Sunday … and I promise, once the wrought iron is installed, I will stop showing photos of and talking about the new parking lot.

Facebook Comments