Our Online Scheduler is So Easy and Convenient!

Because the Internal Revenue Service opened their computer system for electronic filing on Monday, January 27th, this past week should count as our first week of Tax Season, even though we did not go on extended hours until Saturday, February 1st (yesterday). Our Tax Season (Feb. 1 – Apr. 15) hours are 8:00 am to 5:00 pm Monday through Saturday.

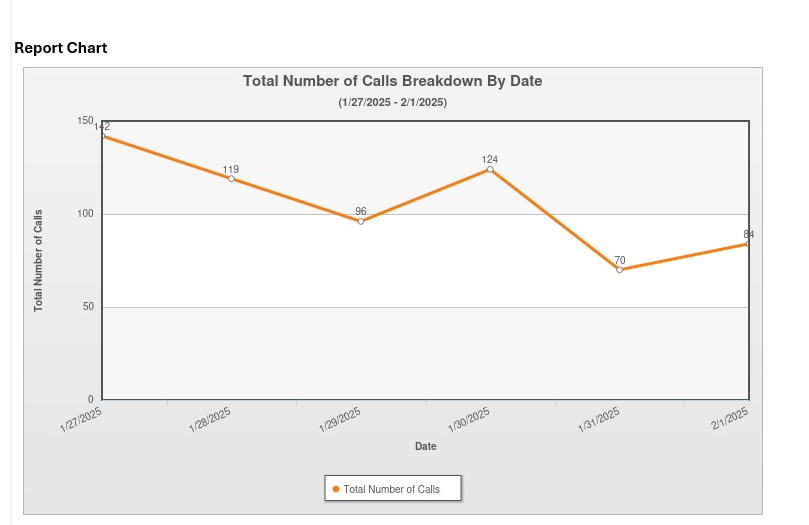

Telephone Traffic this Week

As you can see in this chart, we averaged approximately 100 calls per day as we kicked off the 2025 filing season. This activity will increase as the busy season progresses. It would be extremely helpful to us if you schedule your appointment online.

This past week one-third of the appointments that were scheduled were made by the client online rather than calling. It is convenient, secure and easy!

Online Scheduling

Select a service to schedule an appointment.

- Telephone Appointment Follow-up & Review after we have processed your documents.

- Telephone Appointment Provide the telephone number at which you will receive the call.

- Tax (In-Office Visit) Tax Appointments may be scheduled for Half-Hour, 1 Hour, 2 Hours or 3 Hours based your needs. See details below.

- Express Income Tax Filing Half-Hour Block – Schedule an appointment to provide information for tax filings. If your appointment usually requires half-hour or less, this is for you.

- Standard Income Tax Filing 1 Hour Block – Schedule an appointment to provide information for tax filings. If your appointment usually requires 1 hour or less, this is for you.

- Advanced Income Tax Filing 2 Hour Block – If you have a Business, Farm, Rental Properties, etc. this is for you. If your appointment normally requires MORE than 1 hour.

- Multiple Income Tax Filings 3 Hour Block – If you are filing multiple returns or have multiple businesses.

- Important

- Consultation Greg Cook will be available during appointments.

- Accounting Dept.

- Payroll & Accounting One Hour Block

This year marks the expiration of the Tax Cuts and Jobs Act of 2017. It may be extended, or we may have other changes that will take its place. We are hopeful that we will have indicators in the coming weeks of the direction our tax laws are headed. Either way, we can assist you by cautiously planning for 2025.

Facebook Comments