The IRS Small Business/Self-Employed Stakeholder Liaison Office holds semi-annual local liaison meetings at IRS headquarters in Birmingham for the tax professional community. These sessions are designed to share important information about IRS programs and issues with representatives of the various tax professional groups and to receive feedback from Enrolled Agents, CPAs and attorneys.

These May and October meetings with the Internal Revenue Service have been a part of my routine for the last twenty years as a representative of ALSEA. Nora Huffman, Senior Stakeholder Liaison at IRS Birmingham arranged for a great program on Wednesday May 13, 2015. This was the first ever meeting that I recall IRS attendees outnumbering the practitioner representatives! Of the 20 people attending, 8 were representatives of the practitioner community (taxpayer representatives), 9 were from IRS, 2 were from the Alabama Department of Revenue and 1 was from the Department of Labor in Atlanta.

A dozen or so trips to 801 Tom Martin Drive in Birmingham each year always reminds me of one of the reasons I’m a country boy. The traffic on Highway 79 (Tallapoosa Street) to I-20/59, to Highway 31/280 (Red Mountain Expressway), to Lakeshore Drive can be like a demolition derby at times. It’s always a small relief to get back to my rural town of Arab.

Our meeting began with a presentation from Brian Kubas and Brian Canty, both Special Agents (Investigators) with the Birmingham Field Office of TIGTA (Treasury Inspector General for Tax Administration). These guys deal with things like; assaults, threats, IRS employee misconduct, theft, fraud, unauthorized access to tax records, unauthorized disclosure of tax information by IRS employees, criminal misconduct by tax practitioners and bribery. As you can see, these guys keep their eyes on both sides of the isle and everyone in between.

The Treasury Inspector General for Tax Administration (TIGTA) was established under the IRS Restructuring and Reform Act of 1998 to provide independent oversight of IRS activities. Through its investigative programs, TIGTA addresses threats arising from lapses in IRS employee integrity, violence directed against the IRS, and external attempts to corruptly interfere with federal tax administration.

TIGTA protects the Department of Treasury’s ability to collect revenue owed to the Federal Government. In order to achieve this, TIGTA’s Office of Investigations (OI) administers investigative programs that protect the integrity of the Internal Revenue Service (IRS) and detect and prevent fraud and other misconduct within IRS programs. This includes investigating allegations of criminal violations and administrative misconduct by IRS employees, as well as protecting IRS against external attempts to corrupt or threaten its employees.

TIGTA’s oversight extends to the IRS, IRS Chief Counsel and the IRS Oversight Board. TIGTA serves as an independent voice reporting directly to the Treasury Secretary and Congress.

Next, we heard from Beverly Thompson and Kelly Farris of the TAS (Taxpayer Advocate Service). The Taxpayer Advocate Service works in two main ways – helping taxpayers with individual problems, and recommending “big picture” or systemic changes at the IRS or in the tax laws. These ladies can be particularly helpful when an IRS problem is causing financial difficulty for a taxpayer or an IRS procedure just isn’t working as it should.

Some of the problems they deal with are not limited to a single taxpayer. The Taxpayer Advocate Service looks at patterns in taxpayer issues to determine if an IRS process or procedure is causing a problem, and if so, to recommend steps to resolve the problem. Each year, the National Taxpayer Advocate presents an Annual Report to Congress, identifying at least 20 of the most serious problems facing taxpayers. In recent years, the key issues in the report have included tax-related identity theft, fraud by certain tax return preparers, and the need for a Taxpayer Bill of Rights (which the IRS has adopted).

I can tell you without hesitation that these two ladies are two of the most popular people in the room at our meetings. Just having the opportunity to informally discuss issues that we see in our practices day-to-day is invaluable. Major changes at the Service have come about as a result of these exchanges.

The Alabama Department of Revenue always sends representatives to these meetings and this year we talked with Revenue Examiners Naima Price and Joni Jackson from the Service Center at Valleydale Road in Hoover. These two ladies shared with us the main issues they are seeing now in State Income Tax Audits.

Knowing what will likely trigger a Tax Audit is important information to me. It affords me the opportunity to identify and discuss an issue with my client before filing the tax return. We can ensure that we properly document the item and will be prepared if and when the audit notice arrives. No surprises!

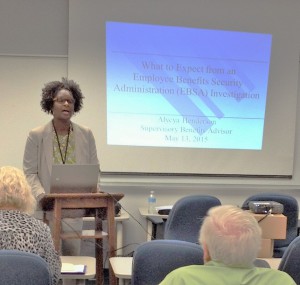

Alycya Henderson from the Department of Labor in Atlanta had the spotlight at this meeting with her presentation on “What to Expect in an EBSA Investigation”. EBSA is the government acronym for Employee Benefits Security Administration. From their Mission Statement on their website: The mission of the Employee Benefits Security Administration is to assure the security of the retirement, health and other workplace related benefits of America’s workers and their families. We will accomplish this mission by developing effective regulations; assisting and educating workers, plan sponsors, fiduciaries and service providers; and vigorously enforcing the law.

Through its enforcement of the Employee Retirement Income Security Act (ERISA), the Employee Benefits Security Administration (EBSA) is responsible for ensuring the integrity of the private employee benefit plan system in the United States. EBSA’s oversight authority extends to nearly 684,000 retirement plans, approximately 2.4 million health plans, and a similar number of other welfare benefit plans, such as those providing life or disability insurance. These plans cover about 141 million workers and their dependents and include assets of over $7.6 trillion (as of October 29, 2014). In FY 2014, EBSA recovered $599.7 million for direct payment to plans, participants and beneficiaries.

In FY 2014, EBSA closed 3,928 civil investigations with 2,541 of those cases (64.7%) resulting in monetary results for plans or other corrective action, exhibiting its ability to effectively target ERISA violators in the employee benefit plan universe.

EBSA often pursues voluntary compliance as a means to correct violations and restore losses to employee benefit plans. However, in cases where voluntary compliance efforts have failed, or that involve issues for which voluntary compliance is not appropriate, EBSA forwards a recommendation to the Solicitor of Labor to initiate litigation. In FY 2014, 161 cases were referred for litigation. Together, EBSA and the Solicitor of Labor determine which cases are appropriate for litigation, considering the ability to obtain meaningful relief through litigation, cost of litigation, viability of other enforcement options, and agency enforcement priorities. EBSA cases referred to the Solicitor’s office for litigation are often resolved with monetary payments, short of litigation. Nationwide in FY 2014, the Department filed suit in 107 civil cases.

EBSA has responsibility to investigate potential violations of the criminal provisions of ERISA and those provisions of Title 18 of the United States Code that relate to employee benefit plans. EBSA conducts most of its criminal investigations with other federal law enforcement agencies under the direction of the United States Attorney for that jurisdiction. Other investigations are conducted in consultation with the appropriate state or local law enforcement authority.

In FY 2014, EBSA closed 365 criminal investigations. EBSA’s criminal investigations, as well as its participation in criminal investigations with other law enforcement agencies, led to the indictment of 106 individuals – including plan officials, corporate officers, and service providers – for offenses related to employee benefit plans.

Facebook Comments