-

Child and Dependent Care Tax Credit

Cook and Company Tax Advisors urges clients not to overlook the Child and Dependent Care Tax Credit. Eligible taxpayers may be able claim it if they paid for someone to care for a child, dependent or spouse last year. Work-Related Expenses The care must have been necessary so a person could work or look for…

-

Tax Filing Deadline Approaches

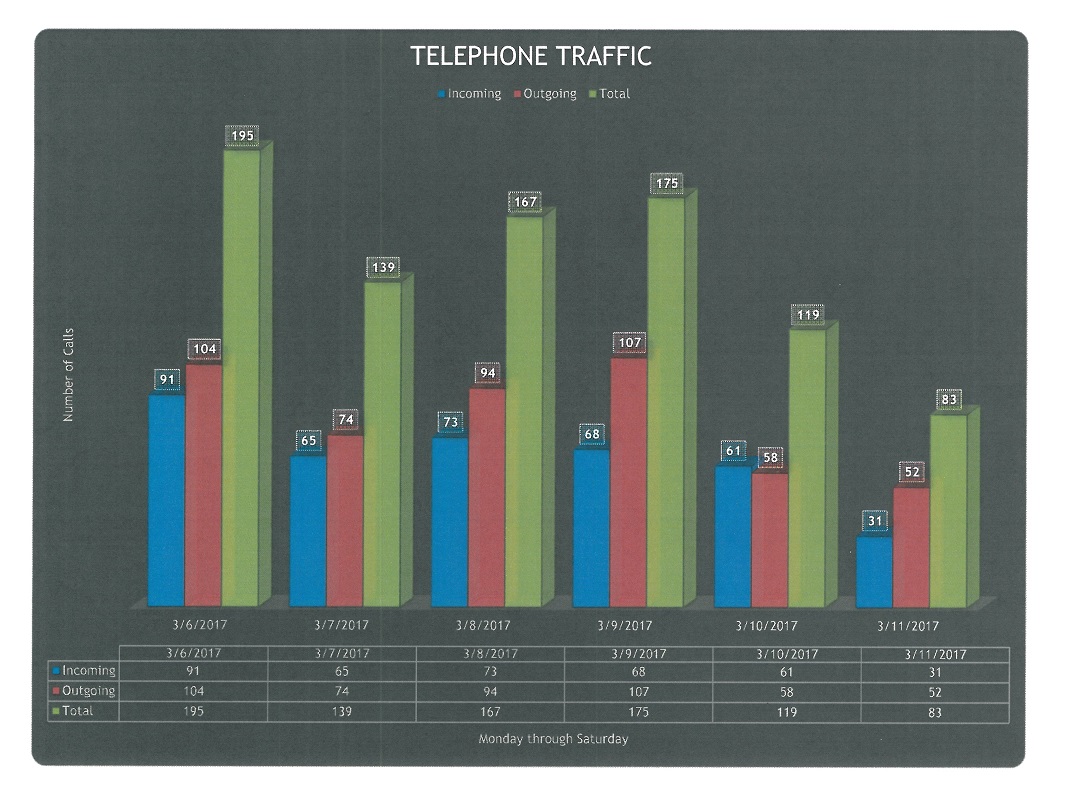

We are quickly approaching our busiest time of the year when our telephone traffic peaks. I want to offer some information that may be helpful to you. Our main telephone number is (256) 586-4111, but we have direct lines from Birmingham (205) 322-7452 and Huntsville (256) 534-6922. If you are calling from anywhere else in the…

-

The IRS Data Retrieval Tool on fafsa.gov and StudentLoans.gov is currently unavailable.

They are working to resolve the issue as quickly as possible. However, at this time, the IRS tells me that they anticipate the online data tool will be unavailable for several weeks. While the Data Retrieval Tool is offline, we have other ways for students and families to find the tax information they need to…

-

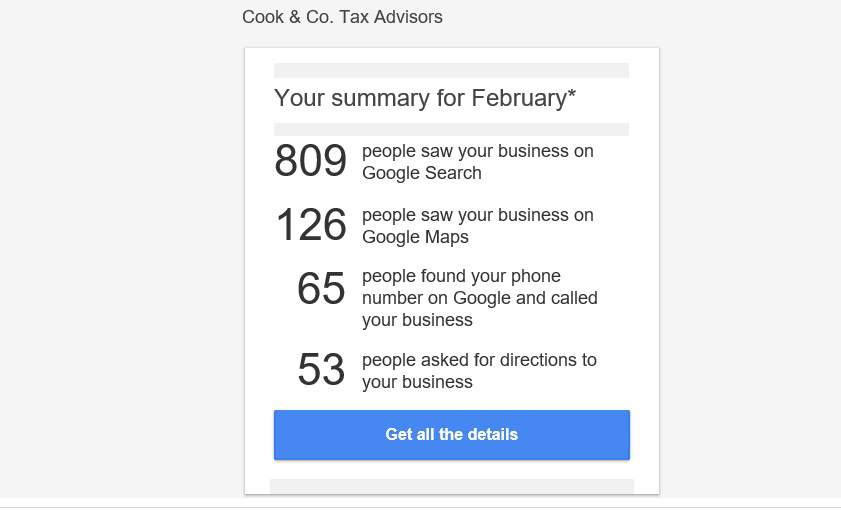

The Nice Thing about these Numbers from Google

This February activity that Google is reporting to me, represents new clients and new business. It is exciting for any business owner to know that their efforts are attracting new customers for their goods or service. With the aging “Baby Boomers”, businesses like mine lose a certain number of customers to death each year. It…

-

What is the Additional Medicare Tax?

Some taxpayers may be required to pay an Additional Medicare Tax if their income is over a certain limit. We would like people to know more about this tax. Tax Rate The Additional Medicare Tax rate is 0.9 percent. Income Subject to Tax The tax applies to the amount of wages, self-employment income and railroad…

-

Don’t Forget to Spring Forward

Daylight Saving Time begins Sunday, March 12, 2017 and will end Sunday, November 5, 2017. Run your clocks forward one hour.

-

Interest Rates Remain the Same for the Second Quarter of 2017

The Internal Revenue Service announced that interest rates will remain the same for the calendar quarter beginning April 1, 2017. The rates will be: four (4) percent for overpayments [three (3) percent in the case of a corporation]; 1 and one-half (1.5) percent for the portion of a corporate overpayment exceeding $10,000; four (4) percent…

-

TIGTA Audit of Affordable Care Act

The Affordable Care Act has become very time consuming for tax advisors. The Chairman of the Senate Finance Committee has now made it time consuming for the office of the Treasury Inspector General for Tax Administration. Not so time consuming however, that they took time to make any recommendations. But then, my guess is that…

-

Debt Cancellation May be Taxable

If a lender cancels part or all of a debt, a taxpayer must generally consider this as income. However, the law allows an exclusion that may apply to homeowners who had their mortgage debt canceled in 2016. If the canceled debt was a loan on a taxpayer’s main home, they may be able to exclude…