-

Sales Tax Change Reminders

7019 Coosa County New Admin Sales/Use Tax 2% Effective February 1, 2017, taxes due on or before March 20th 7019 Coosa County New Admin Lodging Tax 6% Effective February 1, 2017, taxes due on or before March 20th 9660 Thomaston New Admin Sales/Use Tax 3% Effective February 1, 2017, taxes due on or before March…

-

The Affordable Care Act

What happens if I fail to reconcile my advance payments of the premium tax credit when I file my return? Here’s what the IRS says. Filing your return without reconciling your advance payments will delay your refund and may affect future advance credit payments. The IRS will send you a letter with instructions about what…

-

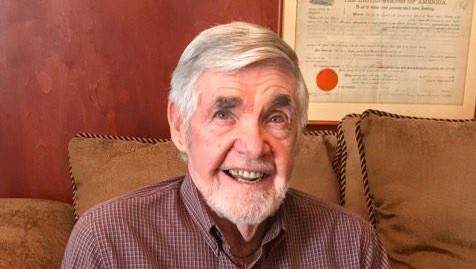

Don Leitner has been a Client of this Firm since 1957

Don just made his 60th trip to Arab to see us. He flew from Merritt Island, Florida to Atlanta and drove over. For the last 34 years, he’s brought Buddy a bag of oranges and a bag of grapefruits when he visits. Words don’t come easy to describe what a special thing it is to…

-

Monkey Business at the Tax Office

Monkey Business at the Tax Office from Gregory J Cook on Vimeo.

-

Process for Victims of W-2 Compromise Scams

The IRS has Established a New and Formal Process for Victims of W-2 Compromise Scams to Report the Incident to IRS. The IRS has established a process that will allow businesses and payroll service providers to quickly report any data losses related to the W2 scam currently making the rounds. If notified in time, the…

-

Many Victims of Identity Theft Not Receiving Identity Protection Personal Identification Numbers

Treasury Inspector General for Tax Administration, Office of Audit determines, Inconsistent Processes and Procedures Result in Many Victims of Identity Theft Not Receiving Identity Protection Personal Identification Numbers. IMPACT ON TAXPAYERS To provide relief to identity theft victims, the IRS began issuing Identity Protection Personal Identification Numbers (IP PIN) to eligible taxpayers in Fiscal Year…

-

March 25

March 25 is the 84th day of the year (85th in leap years) in the Gregorian calendar. There are 281 days remaining until the end of the year. On this date in 1965 civil rights activists led by Martin Luther King Jr. successfully complete their 4-day 50-mile march from Selma to the capitol in Montgomery,…

-

Treasury Offset Program

Was your income tax refund taken or less than expected? The Treasury Offset Program can use all or part of your federal refund to settle certain unpaid federal or state debts, to include unpaid individual shared responsibility payments. The Department of Treasury’s Bureau of the Fiscal Service, or BFS, runs the Treasury Offset Program. The…

-

Adoption Tax Credit

Taxpayers who have adopted or tried to adopt a child in 2016 may qualify for a tax credit. Here are a few important things about the adoption credit: The Credit The credit is nonrefundable, which may reduce taxes owed to zero. If the credit exceeds the tax owed, there is no refund of the additional amount. In…