-

Some Taxpayers Get Extensions without Asking

Taxpayers Abroad, in Combat Zones and Disaster Areas Qualify Even though April 18 is the tax-filing deadline for most people, some taxpayers in special situations qualify for more time without having to ask for it, according to the Internal Revenue Service. Taxpayers in Presidentially-declared disaster areas, members of the military serving in a combat zone…

-

New Filing Deadline Now Applies to Foreign Account Reports

Reminders for those with Foreign Assets of U.S. Tax Obligations Reminder for U.S. citizens and resident aliens, including those with dual citizenship, to check if they have a U.S. tax liability and a filing requirement. At the same time, the agency advised anyone with a foreign bank or financial account that a new deadline now…

-

Important Office Hours Announcement

We will close Tuesday April 18th at 5:00 p.m. and Reopen Monday April 24th at 9:00 a.m. Rest assured that all last-minute tax returns have been filed electronically and all last-minute extensions have been filed electronically. Monday April 24th is the start of our After Tax-Season Schedule of Monday through Thursday 9:00 a.m. to 5:00…

-

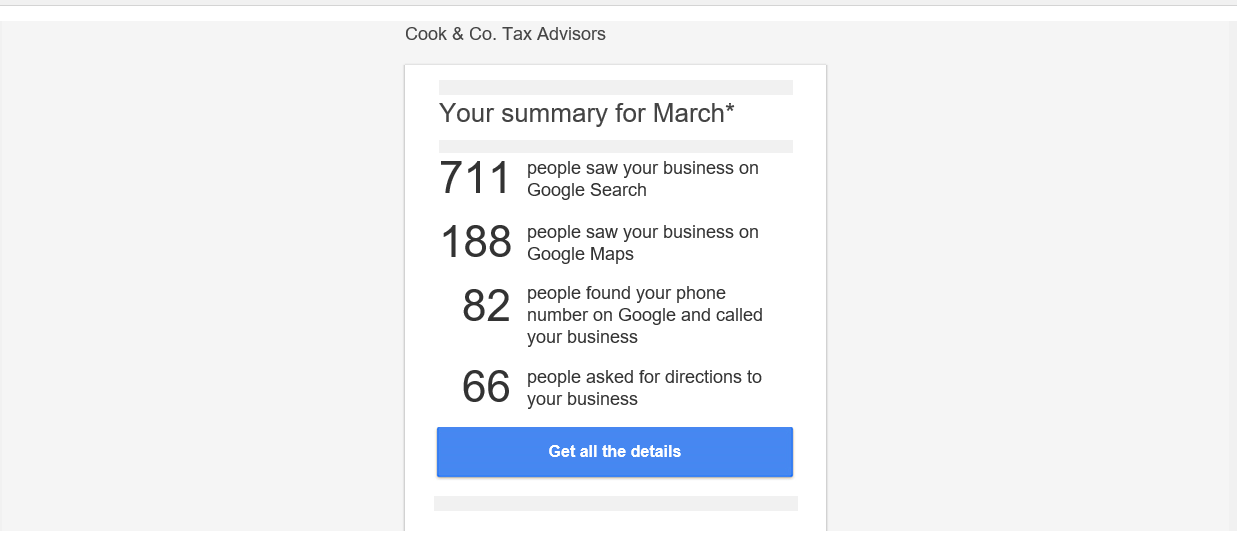

Our Google Activity in March

As our 2017 tax filing season comes to a close, I want to express my appreciation to all of the staff for a job well done. I need to recognize our seasonal employees that come in to make it possible for us to handle such a heavy workload in a very short time frame. These…

-

Need an Extension of Time to File Taxes?

This year’s tax-filing deadline is April 18. Taxpayers needing more time to file their taxes can get an automatic six-month extension from the IRS. Remember, more time to file is not more time to pay. Requesting an extension to file provides taxpayers an additional six months (until Oct. 16) to prepare and file taxes. However,…

-

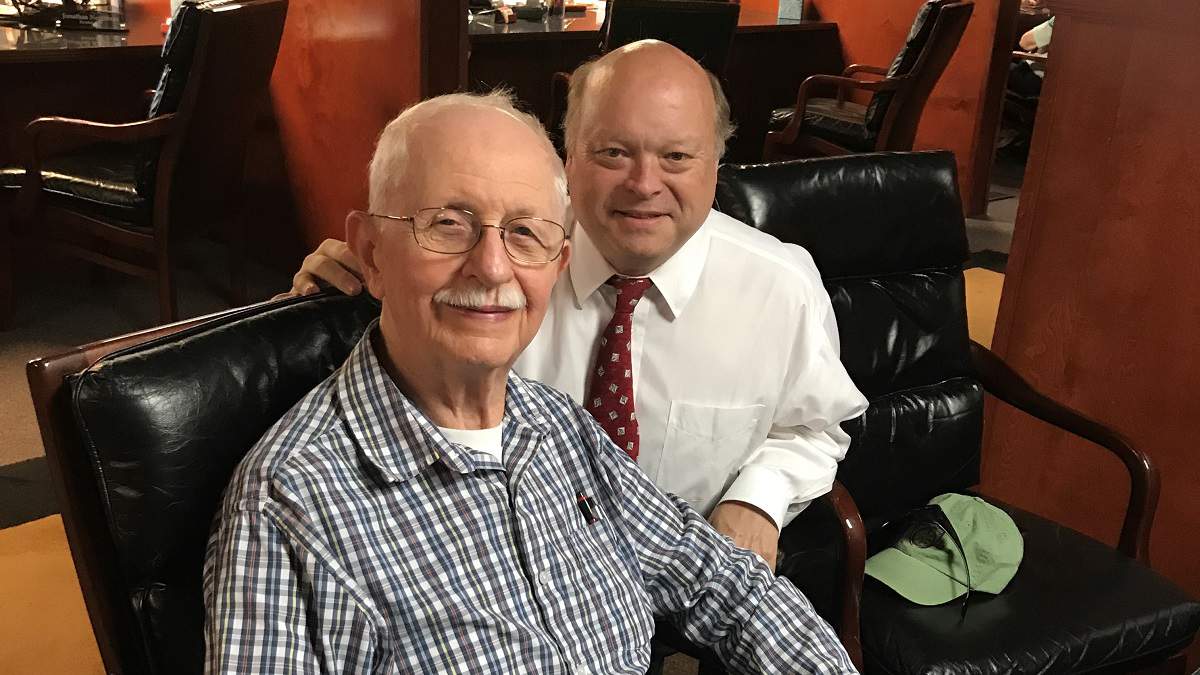

George has been a Client since 1962

Anthony Nash, CPA working with George Wertz, who has been coming to our firm to file his taxes every year since 1962. That was before the Beatles came to the United States, before Neil Armstrong walked on the moon and this year marks his 55th Annual Trip to Arab. We love you and God Bless…

-

Affordable Care Act

Assessment of Efforts to Implement the Employer Shared Responsibility Provision The Affordable Care Act’s Employer Shared Responsibility Provision requires employers with an average of 50 or more full-time employees (including full-time equivalent employees) to offer health insurance coverage to full-time employees and their dependents beginning in January 2015. Employers who did not offer health insurance…

-

New Option for Claiming Research Credit

For Small Business Startups, IRS Explains New Option for Claiming Research Credit; Option Still Available for Those That Already Filed The Internal Revenue Service issued interim guidance explaining how eligible small businesses can take advantage of a new option enabling them to apply part or all of their research credit against their payroll tax liability, instead…

-

Interim Results of the 2017 Filing Season

The Treasury Inspector General for Tax Administration (TIGTA) Releases Interim Results of Report on 2017 Tax Filing Season. The final report with recommendations to the IRS will be released in September. In preparation for the 2017 Filing Season, the IRS made significant changes to its processes and procedures to address legislative requirements, including the program…