-

Happy Fourth of July!

We will close the office at 1:00 this afternoon and reopen Wednesday July 5th at 9:00. Independence Day commemorates the adoption of the Declaration of Independence 241 years ago on July 4, 1776. The Continental Congress declared that the thirteen American colonies regarded themselves as a new nation, the United States of America, and were no…

-

Interest Rates Remain the Same for the Third Quarter of 2017

The Internal Revenue Service today announced that interest rates will remain the same for the calendar quarter beginning July 1, 2017. The rates will be: four (4) percent for overpayments (three (3) percent in the case of a corporation); 1 and one-half (1.5) percent for the portion of a corporate overpayment exceeding $10,000; four (4)…

-

We Just Returned from a Two-Day Tax Seminar

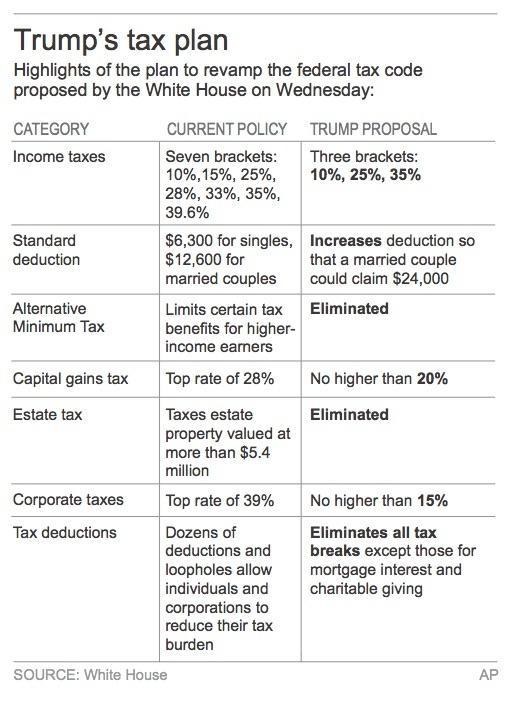

Each year we attend a two-day tax seminar put on by the Alabama Society of Enrolled Agents (ALSEA) the Monday and Tuesday before Memorial Day. Our 2017 Spring Seminar was held at the Birmingham Hilton. Our guest speakers were Ben Tallman, USTCP, EA, BBA and Dr. Roger Roemmich. The hot topic was “Trump Tax Reform”.…

-

Closed for Seminar Monday and Tuesday

Our office will be closed Monday May 22 and Tuesday May 23, 2017 for Continuing Education Development. We will reopen Wednesday May 24th. Our Enrolled Agents sustain a high level of expertise with the ever-changing tax code. EAs must acquire 30 hours of continuing education per year in order to maintain their license from the…

-

Internet Security is back in the News

These hackers and ransomware are wreaking havoc on businesses and institutions. What is perplexing to me, is the fact that this last exploit was directed at Windows XP (not deployed here since 2007), Windows 8 (never deployed here) and Windows Server 2003 (not deployed here since 2008), all old systems that even a small firm…

-

Many Tax-Exempt Organizations Must File by May 15

Cook and Company Tax Advisors today reminded tax-exempt organizations that many have a filing deadline for Form 990-series information returns in mid-May. With the May 15 filing deadline fast approaching, the firm cautions these groups not to include Social Security numbers or other unnecessary personal information on their Form 990. The company also asks them…

-

Home Office Deduction Often Overlooked by Small Business Owners

Cook & Co. Tax Advisors today reminds small business owners who work from a home office that there are two options for claiming the Home Office Deduction. The Home Office Deduction is often overlooked by small business owners. As part of National Small Business Week (April 30-May 6), Cook & Company is highlighting a series…

-

Trump Releases One Page Plan

At first glance, I immediately wondered how they could do away with Employee Business Expense Deductions. Many employees that are required to use their personal automobile for work, that are not reimbursed for that mileage, would be devastated (mostly outside sales people). And, they will tax us on income we do not get to keep,…

-

Important Facts about Filing Late and Paying Penalties

April 18 was this year’s deadline for most people to file their federal tax return and pay any tax they owe. If taxpayers are due a refund, there is no penalty if they file a late tax return. Taxpayers who owe tax, and failed to file and pay on time, will most likely owe interest…