-

Round-Up Settlement Issue

The recent Round-Up cancer settlement cases continue to generate frustration among claimants, particularly highlighting the complicated nature of legal and medical expense deductions. In a case we reviewed today, one client received an initial settlement of $70,000 but was left stunned after deductions significantly reduced her payout. After attorney fees, court costs, and medical liens…

-

The Last Week of March, First Week of April

This is always our busiest time at the office … Tax season can be stressful, especially if you’re not quite ready by the filing deadline. Fortunately, the IRS offers taxpayers an option to file an extension, granting extra time to complete their tax returns. Here’s what you need to know: What is a Tax Extension?…

-

FinCEN Removes Beneficial Ownership Reporting Requirements for U.S.

FinCEN Removes Beneficial Ownership Reporting Requirements for U.S. Companies and U.S. Persons, Sets New Deadlines for Foreign Companies Consistent with the U.S. Department of the Treasury’s March 2, 2025 announcement, the Financial Crimes Enforcement Network (FinCEN) is issuing an interim final rule that removes the requirement for U.S. companies and U.S. persons to report beneficial…

-

First Day of Spring Brings Cool Weather to Arab, Alabama

Thursday, March 20, 2025 marks the official first day of spring, known as the vernal equinox, when day and night are roughly equal in length. In Arab, Alabama, residents woke up to crisp temperatures signaling that winter’s chill hasn’t fully released its hold quite yet. With a predicted high of just 46 degrees Fahrenheit, today…

-

A Lot of Excitement this Week

The Ides of March: A Day of Betrayal and History The Ides of March, falling on March 15, is most famously remembered as the day Julius Caesar was assassinated in 44 BCE. The term “Ides” comes from the Roman calendar, marking the middle of the month, often falling on the 13th or 15th depending on…

-

Spring Forward

Today is the 2nd Sunday in March Daylight Saving Time (DST) is the practice of setting clocks forward by one hour in the spring and back by one hour in the fall to make better use of natural daylight. Originally proposed by Benjamin Franklin and later adopted by several countries during World War I to…

-

What If March Comes in Like a Lamb?

Does that mean it will go out like a Lion? Well, that may be the case with the weather, however, if we are talking about our workload, March is definitely coming in like a Lion and we expect it to go out like a Lion as well. We have prepared 889 tax returns by the…

-

My Sunday Morning Blog Post

What a Week! Thursday morning began with snowfall here in Arab, Alabama, which is a rarity. The roads were clear and everyone exercised caution. We started off the week with a high temperature of 49° and each day thereafter the temperature decreased, reaching only 23° as the high on Thursday. We even saw some light…

-

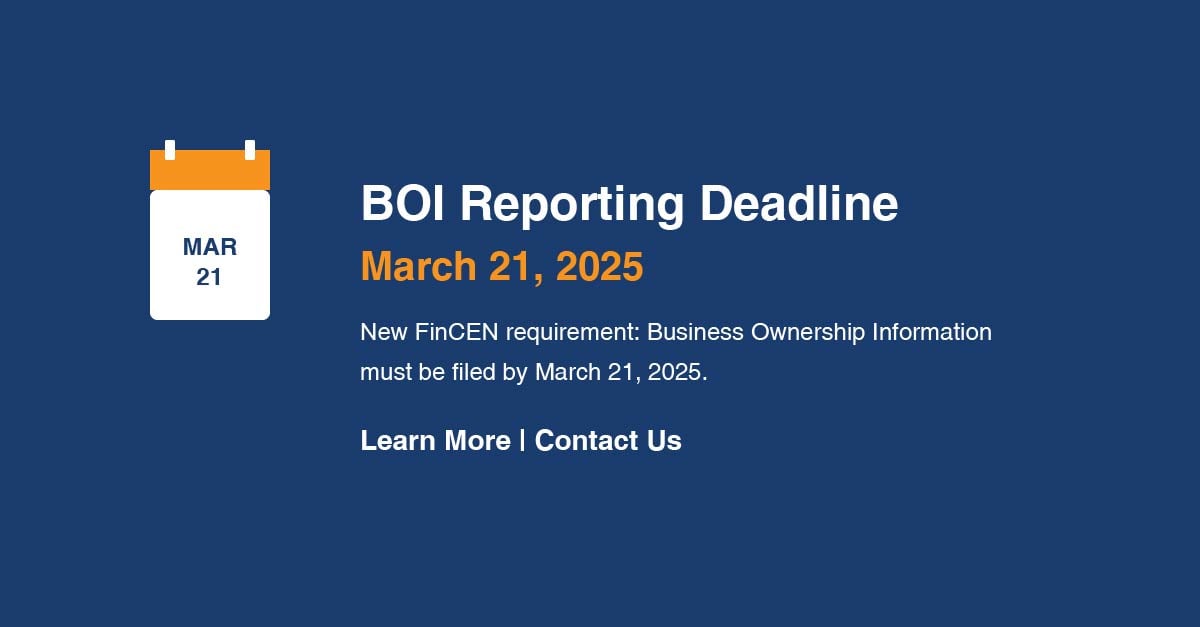

New Deadline of March 21, 2025

For BOI Filings with FinCen Corporate Transparency Act Reporting Requirements Back in Effect with Extended Reporting Deadline; FinCEN Announces Intention to Revise Reporting Rule Following the February 18, 2025, decision by the U.S. District Court for the Eastern District of Texas in Smith, et al. v. U.S. Department of the Treasury, et al., 6:24-cv-00336, the…