As we awaken an hour early (or late) this morning, due to the time springing-forward, we find ourselves at the halfway point of the tax filing season.

As the calendar flips to February 1, the tax filing season officially kicks off, marking the start of a crucial period for individuals and businesses alike. Spanning just ten weeks, this season concludes on April 15, a deadline ingrained in the minds of Americans nationwide. Within this tight timeframe, taxpayers are tasked with compiling a year’s worth of financial information, making sense of complex tax laws, and ultimately submitting their tax returns to the Internal Revenue Service (IRS). With March 10th serving as the midway point, it’s imperative to approach this season with a strategic plan to ensure a smooth and successful filing experience.

Understanding the Timeline

The tax filing season is a fixed period each year, but its compact nature often catches taxpayers off guard. Starting on February 1, it offers a limited window of opportunity to get one’s financial house in order. As the season progresses, the pressure builds, especially as March 10th, the halfway mark, approaches. This milestone is a critical reminder for those who have yet to start their tax preparation process, signaling that time is of the essence.

Preparing for Success

Success during tax season is predicated on preparation. The earlier taxpayers begin organizing their documents, the better. Key forms and documents, such as W-2s from employers, 1099s for independent contractors, and records of any investments or deductions, are foundational to accurately completing a tax return. Employing a systematic approach to gathering these documents can alleviate much of the stress associated with tax filing.

Leveraging Technology

In today’s digital age, leveraging technology can streamline the tax preparation process. Numerous software programs and online platforms are designed to guide taxpayers through their returns, ensuring accuracy and maximizing potential deductions and credits. These tools can also estimate tax liabilities or refunds, providing valuable insights early in the season.

Understanding Tax Changes

Tax laws are not static; they evolve, reflecting changes in legislation and policy. Staying informed about these changes is crucial, as they can significantly impact one’s tax obligations and opportunities for savings. For instance, new deductions or credits might be available, or previous ones may have been altered or phased out. A proactive approach to understanding these changes can lead to more favorable tax outcomes.

Seeking Professional Help

For many, the complexity of tax laws and the fear of making mistakes warrant seeking professional assistance. Tax professionals not only provide peace of mind but can also offer strategic advice tailored to individual financial situations. Their expertise can uncover opportunities for savings that might otherwise be overlooked. Importantly, engaging a tax professional early in the season is advisable, as their schedules become increasingly packed as April 15 approaches.

Common Pitfalls to Avoid

Procrastination is perhaps the most significant pitfall during tax season. Waiting until the last minute can lead to rushed decisions, overlooked deductions, and increased stress. Moreover, inaccuracies in tax returns due to haste can trigger audits by the IRS, leading to potential penalties and interest on unpaid taxes.

Another common mistake is underestimating one’s tax liabilities. Taxpayers should use the early weeks of the season to estimate their obligations accurately, ensuring that they have the necessary funds available by the deadline. Failure to do so can result in interest and penalties, compounding the financial burden.

Filing Options and Deadlines

Taxpayers have several options for filing their returns, including paper filing and electronic submission. Electronic filing is encouraged by the IRS for its speed and accuracy. Returns filed electronically are typically processed faster, resulting in quicker refunds for those eligible.

The April 15 deadline is non-negotiable for most taxpayers. However, individuals who need more time can file for an extension, granting them until October 15 to submit their returns. It’s crucial to note, however, that an extension to file does not extend the time to pay any taxes owed. Payments are still due by April 15 to avoid penalties and interest.

Conclusion

The tax filing season, while daunting, offers an opportunity for taxpayers to assess their financial health, make informed decisions, and potentially uncover savings. By understanding the timeline, preparing diligently, and avoiding common pitfalls, taxpayers can navigate this season with confidence. Whether choosing to tackle the process independently or seek professional assistance, the key to a stress-free tax season lies in early and thorough preparation. As the season progresses, keeping an eye on the calendar, especially as March 10th comes and goes, will ensure that taxpayers remain on track for a successful filing by April 15.

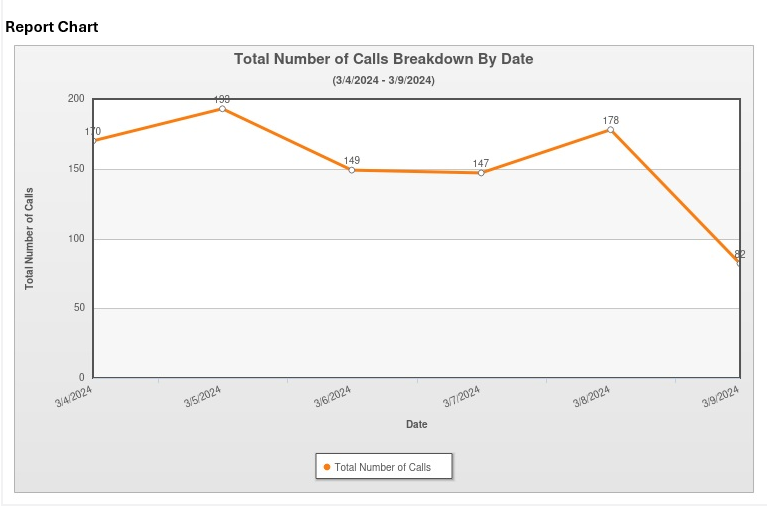

This past week we had 603 outgoing telephone calls and 317 incoming calls. Those 920 conversations between staff and clientele illustrate the step-up in activity as the season progresses. As of today, we have prepared and filed 1,136 tax returns, which represents 138 more than this same time last year.

Facebook Comments