“Keep Copies” of your electronically filed returns are on the way!

Although we’ve been able to file returns electronically since January 24th, we were unable to print the paper versions of the forms until yesterday when the software update came. We had a backlog of 645 files, all of which had been filed, just not yet printed to either pdf format for upload to the portal or paper copies for mailing. The delays involved the Internal Revenue Service, State Department of Revenue and our software provider.

Tips to Avoid Potential Headaches with your Tax Filings

TIP #1 – Avoid anything involving Paper and the U.S. Mail if at all possible. Everything from filing the returns (with a few exceptions), paying a balance due, receiving a refund and even paying quarterly estimated tax payments in the coming year can be done electronically. If you mail a check and payment voucher to the IRS, a clerk has to open the envelope and post the payment to your account. Should that clerk key one number wrong in your Social Security number for example, it will cause a calamity like you have never experienced.

The IRS computer will send a Notice to you, advising that you owe unpaid taxes. In order for us to prove that you made the payment, you will have to obtain a copy of the backside of your cancelled check for the IRS to see where the payment was misapplied. A copy of the frontside of the check will not suffice. Most financial institutions do not provide the copy of the backside of a check anymore. It may involve a special request to your bank or credit union to obtain it.

In recent times, the U.S. Mail has become so unreliable, that we no longer have confidence in correct and timely delivery. One client who insisted on sending a $100,000 estimated tax payment in January by paper, has yet to see the check clear their bank. The IRS will likely penalize the client and without a certified receipt, we have nothing to prove the couple mailed a check. One time we provided a certified mail receipt to the IRS as evidence and the IRS Representative questioned how we could prove the contents of the mailing!

Just last week a lady related a story to me of her mother, who lives in Colorado, mailing checks to her granddaughter and grandson. The checks were mailed at the same time, with the destination city being the same. The grandson received his check in time for Christmas, however, the granddaughter’s check arrived two weeks later. What could have possibly happened? Whatever it was, it wasn’t good.

TIP #2 – Make an extra effort to provide all of your source documents at once. Here’s a checklist to assist you. If your file has to go in our “HOLD DRAWER” awaiting a document, it will not come out of the “Hold” status until we receive the required information. Our process is very streamlined and the steps required to move your file from start to finish are very involved. The various staff collectively devote on average 5.5 to 7.5 hours to complete the finalizing and filing of each tax return processed through this office. The deviation of directing a file to “Hold” status can involve otherwise avoidable delays.

TIP #3 – Schedule your In-Office Visit or Telephone Appointment online. Our online appointment scheduler is fast, secure and easy. If you are scheduling a telephone appointment, just put “telephone” in the notes section. You can browse and select the appointment time that fits your busy schedule. You can take your time and take care of it while on the couch, in your pajamas at ten o’clock at night. In fact, I just saw a notification where a client scheduled his appointment in two weeks, and it’s 6:30 am on Sunday morning! NOTE: If you are scheduling a telephone appointment, please upload your documents to us at least 48 hours prior to the appointment.

The COVID Pandemic has had a tremendous impact on our operations.

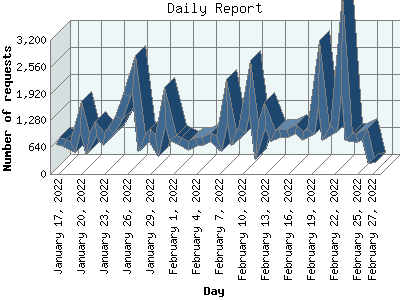

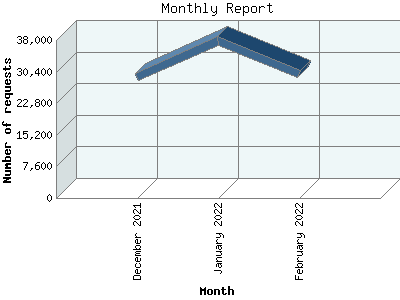

A very large number of our clients have been working for their employers remotely from home. As they become more tech savvy, many are opting to work with us remotely. With such a transition, we are finding that we have to modify many of our processes in order to adapt to the volume of online activity.

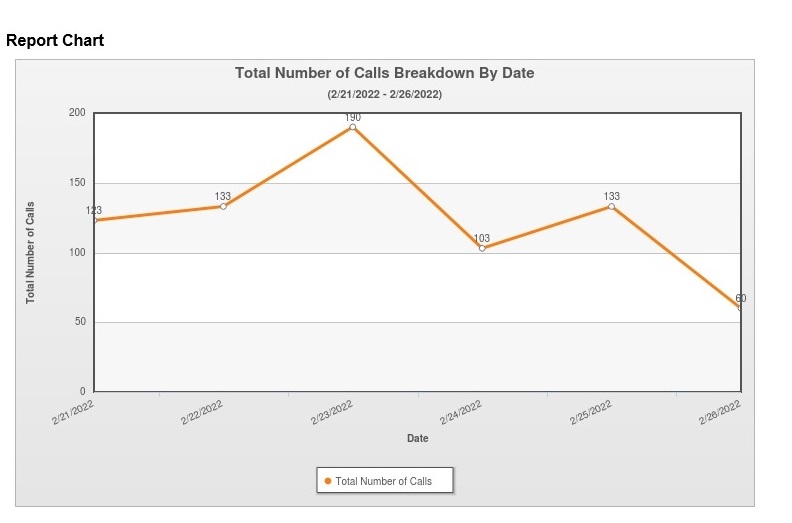

Online Activity

We’re pretty busy here in Arab, Alabama.

For those of you who are making your annual pilgrimage to Arab to see us, I want you to know that we are taking every precaution and following CDC Guidelines for best practices. It’s hard to believe that it was two years ago that I removed all of the magazines, books and reading materials from the lobby. I have to laugh when someone who’s been coming for years, makes a comment about the old coffee table that belonged to Elvis Presley. The plaque had always been covered up with magazines until now.

I followed Walmart’s lead and stopped requiring masks on February 14th. However, we avoid direct contact and maintain six feet distance at all times. We have dividers in place at all desks and counters. I also have two machines, one in the front office and one in the Tax Department that will kill the virus if it is in the air. These machines utilize advanced technology, including ultra-violent light, particle manipulation and two different filtration processes. Unfortunately, our kitchen is still not operating at 100% and we do not have the chocolate candy dishes throughout the office. Hopefully those will return soon. We provide hand sanitizer and still have a stepped-up cleaning & maintenance plan in place.

My sincere thanks to you 645 early filers, for your patience with me and my staff!

You may have heard me say this in the past, but I always enjoy stating the obvious. Running my office during Tax Season is like flying a Jumbo Jet. The hardest part is Taking Off and Landing. Once we get to Cruising Altitude I can almost put it on Automatic Pilot. With this software update that actually came late Friday, we are moving toward catching up in our processes and by the end of this coming week, we should be humming.

Facebook Comments