As taxpayers get ready to file their 2020 tax return, they should start by gathering their records. Taxpayers should gather all year-end income documents to help ensure they file a complete and accurate 2020 tax return and avoid refund delays.

Taxpayers should have all necessary records handy, such as W-2s, 1099s, receipts, canceled checks and other documents that support any income, deductions or credits on their tax return.

Most taxpayers should have already received income documents including:

- Forms W-2, Wage and Tax Statement

- Form 1099-MISC, Miscellaneous Income

- Form 1099-INT, Interest Income

- Form 1099-NEC, Nonemployee Compensation

- Form 1099-G, Certain Government Payments; like unemployment compensation or state tax refund

- Form 1095-A, Health Insurance Marketplace Statements

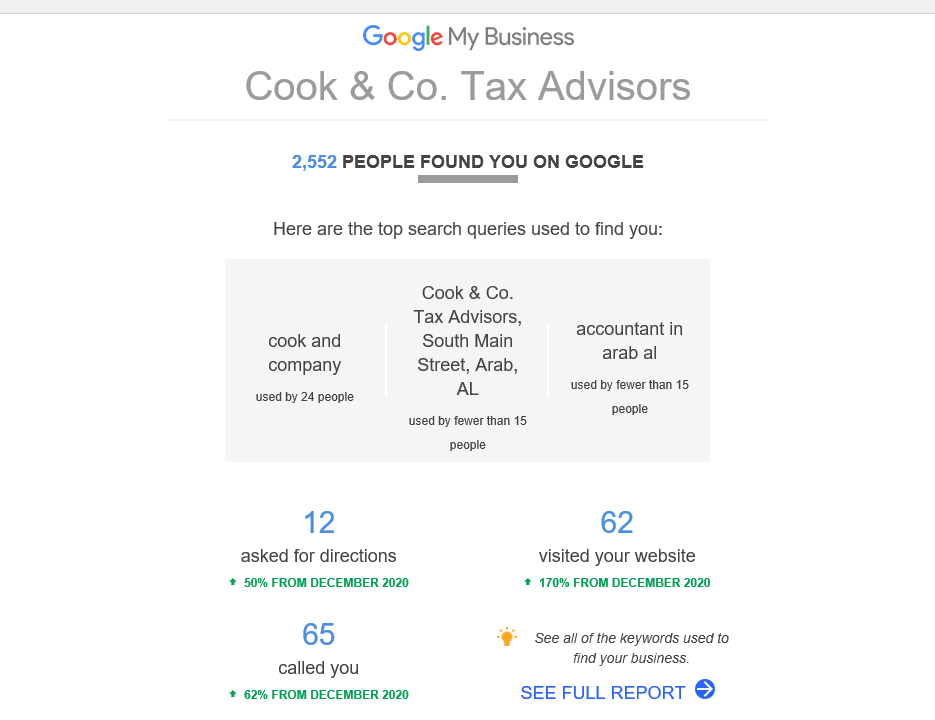

Our 2021 Tax Filing Season is going GREAT! Check out what Google had to say about the month of January.

Facebook Comments