The Internal Revenue Service (IRS) Data Book is published annually by the IRS and contains statistical tables and organizational information on a fiscal year basis. The report provides data on collecting the revenue, issuing refunds, enforcing the law, assisting the taxpayer, and the budget and workforce.

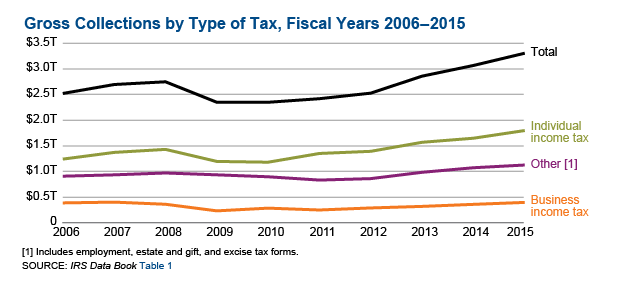

During FY 2015, the IRS collected more than $3.3 trillion, processed more than 243 million tax returns and other forms, and issued over $403 billion in tax refunds.

Individual income tax withheld and tax payments, combined, totaled almost $1.8 trillion before refunds. The IRS also collected almost $389.9 billion in income taxes, before refunds, from businesses in FY 2015.

Paid preparers filed nearly 78.1 million tax returns electronically. The IRS audited a total of almost 1.4 million tax returns, approximately 0.7 percent of all returns filed in Calendar Year (CY) 2014. The IRS audited 0.8 percent of all individual income tax returns filed in CY 2014, and 1.3 percent of corporation income tax returns (excluding S corporation returns).

Facebook Comments